Author: the CaLP team

The Cash Learning Partnership has launched a brand new website: calpnetwork.org. In response to feedback and demand from stakeholders around the world, CaLP’s new website will provide a one stop shop for news, discussion, resources, events and training related to cash and voucher assistance (CVA).

In particular, calpnetwork.org offers:

- The ability to browse in English, French, Spanish and Arabic

- An improved search function to easily find publications, blogs and other resources

- Accessible listing pages for events, trainings and e-learning courses

- The latest comment and opinion from experts on topics related to CVA

As part of the 2018 floods response, the Kenya Red Cross Society (KRCS) received funds from the Government of Kenya to implement a large-scale shelter intervention in 25 counties across the country using a mixed modality approach of cash and in-kind assistance. Although the use of cash for shelter interventions was new to KRCS, their extensive experience with cash assistance and having well-functioning markets in the targeted areas for the shelter programme suggested cash would be cheaper, faster, and easier to implement along with in-kind assistance, instead of purely in-kind delivery. Cash was provided to purchase materials such as sand and stones, as well as cover labour costs.

Using cash for shelter presented a range of risks and liabilities which have been assessed against cost-efficiency and choice for those receiving the cash grant. Before implementing the cash for shelter project, it has been important to reach clarity on how to use cash to ensure shelter needs of those affected by the crisis would be met, sufficient organisational capacity was in place and ensure that the lack of sector specific tools would not affect the success of the project.

This project has also shown the relevance and the potential of using a mixed approach that included the use of a Participatory Approach for Safe Shelter Awareness (PASSA), cash and voucher assistance and the RedRose data management system to manage data of those receiving assistance and distribution of in-kind assistance.

To find out more about the implementation of this shelter recovery programme, you can read a case study on “Safe Rebuilding: A Mixed Approach to Shelter Response Following the 2018 Floods in Kenya” or watch:

- A short video on the “ICHA Shelter reconstruction process learning review” (2’21”) rel=”noopener noreferrer”

- The full version of the documentary film on the “ICHA Shelter reconstruction process learning review” (9’05”)

Kızılaykart is a platform where humanitarian, private, and public sectors come together to provide regular cash support through banking infrastructure to vulnerable people. In order to provide the basic needs of vulnerable groups an “In Camp Food Assistance Programme” was initially implemented within the scope of Kızılaykart project, which later became a platform hosting eight different programmes with different conditions and payment regulations. The objective is to offer support to communities with ; basic needs, education, livelihood, and protection-based humanitarian programmes and contribute to social cohesion in Turkey.

Read more about Kızılaykart directly on the new website and access information about its different programmes.

- Visit: platform.kizilaykart.org

As thousands of people are moved in the evacuation of the area around the Taal volcano in the Philippines, Ecuador – which has more than 20 active volcanoes – is looking at how to protect people there.

As thousands of people are moved in the evacuation of the area around the Taal volcano in the Philippines, Ecuador – which has more than 20 active volcanoes – is looking at how to protect people there.

A scientist based in Quito has designed a system to forecast dangerous activity. The Red Cross is working closely with him, so they can now warn people of potential disaster further in advance – giving a bigger time window in which to move themselves and livestock, and get medical backup in place.

It is part of a radical rethink in the way humanitarian aid is delivered, using forecasts to give people more warning and help them prepare before nature strikes. But funding a project like this means asking donors to donate cash to a disaster which may never happen.

- Listen to this podcast about forecast-based finance and the work of the Red Cross in Ecuador.

(Original Source of the article: BBC, People Fixing the World Podcasts)

Join the debate and support Humanitarian Cash and Voucher Assistance during the 33rd International Conference

This International Conference will include opportunities for participants to discuss or contribute to strengthening the work of the International Red Cross and Red Crescent Movement in the field of humanitarian Cash and Voucher Assistance (CVA), by:

- Participating to a side event on cash

- Signing a pledge on Cash and Voucher Assistance

- Visiting the Cash Hub stand at the Humanitarian Village

- Joining the debate online, which will also be open to the wider humanitarian community

To find out more about the 33rd International Conference visit the website dedicated to this event.

Side Event on “Humanitarian Cash: Giving Dignity to People in Crisis”

On the 11th of December, join a discussion on the role of cash in humanitarian assistance, opportunities and challenges for delivering cash to people in crisis, the potential for collaboration, and how to be “cash ready” organisations. The panel discussion will be moderated by Dylan Winder from the UK Mission to the UN and include the following panellists:

- Dr Abbas Gullet, Kenya Red Cross

- Ms Birgitte Bischoff Ebbesen, Danish Red Cross

- Mr Alexei Castro, Honduran Red Cross

- Mr Georges Kettaneh, Lebanese Red Cross

- Mr Hai Anh Nguyen, Vietnam Red Cross

How to find the Side Event, if you are participating at the International Conference?

The Side Event will take place on Wednesday 11th December 2019, 13h00-14h00 in Room Montreux, Centre de Conference Varembé.

Humanitarian Cash and Voucher Assistance Pledge

The 33rd International Conference is an important opportunity for the Movement to strengthen commitments to increasing the use of cash in humanitarian action. A Cash and Voucher Assistance Pledge has been co-signed by British Red Cross, Danish Red Cross, Kenya Red Cross, Lebanese Red Cross, Mongolian Red Cross, Turkish Red Crescent, ICRC, and will be open for other National Societies and governments to sign and support its commitments.

To read the full pledge and sign click on the link below or ask the Cash Hub stand volunteers at the Humanitarian Village to support you:

https://rcrcconference.org/pledge/humanitarian-cash-and-voucher-assistance/

Visit the Cash Hub stand at the Humanitarian Village

The Cash Hub will be part of the Humanitarian Village between 9 and 12 December. If you are participating at the Conference, come and visit to find out more about the Movement’s cash activities, access resources and discover how to join the Online Cash Community and more.

How to join the conversation online, even if you are not attending?

Conference participants and the wider humanitarian community are invited to join the conversation on social media using the hashtag #RCRC19. To share your views, questions, and ideas related to Cash and Voucher Assistance please join the online conversation adding one or both of the following hashtags:

#RedCrossCash #RedCrescentCash

We would love to hear your thoughts about the use of Cash and Vouchers in humanitarian action!

By La urel Selby

urel Selby

CEA Hub Content officer, British Red Cross

What is the Community Engagement Hub?

The British Red Cross, in close collaboration with the International Federation of Red Cross and Red Crescent, has launched its Community Engagement and Accountability (CEA) hub to provide tools, resources and training materials to volunteers and staff within the Red Cross Red Crescent Movement and aid workers across the sector.

The CEA hub, which has been funded by the UK’s Department for International Development, is a free online platform with over 300 resources, providing a ‘one stop shop’ for anyone mainstreaming community engagement and accountability. Materials range from a ready-to-download three-day training package, to a toolkit designed to help set up and manage complaint and feedback mechanisms in any context.

Community engagement and accountability is a core approach within the Movement, that puts people at the centre, promoting a two-way communication to provide timely and relevant information to communities, while allowing them to participate in decision-making processes.

Sophie Everest, British Red Cross community engagement and accountability adviser, said:

“Aid operations only work when we work with people. When we engage, we learn, and we create a better response for people in need. We are seeing the difference this work makes right now during the Ebola outbreak in Democratic Republic of Congo. By listening and acting on community feedback, the Red Cross has been able to gain acceptance and access in more areas. Over 880 volunteers have gone door-to-door to exchange information and address concerns.”

Cash Assistance and CEA:

The Red Cross and Red Crescent Movement often uses humanitarian cash assistance to help people affected by a crisis. It is essential that we apply participatory approaches when carrying out this work, to make sure that we meet people’s needs and deliver cash according to the preferences of the communities we work with.

Sophie Everest, British Red Cross community engagement and accountability adviser, said: “Cash transfers can be a better way to help people, even in some of the most complicated contexts, and are often more cost-effective for humanitarian agencies. The engagement of affected communities in decision making processes related to cash is integral to ensuring we are distributing cash in the right way to the right people. Not doing this can spread misinformation and rumours, and can create or exacerbate tensions within communities. This can cause harm and runs the risk of undermining the reputation of the Red Cross and Red Crescent Movement and the trust we have built over many years with the people we serve.”

To support volunteers and staff within the Red Cross Red Crescent Movement incorporate community engagement and accountability into their cash activities, the CEA Hub hosts a page dedicated to the incorporation of CEA into cash programmes. This section includes case studies, research and guidance which can help to understand people’s experiences during and after emergencies in the context of cash operations.

Cash and CEA in action:

Community engagement and accountability has been integrated into cash programmes across the globe, from cash transfer programmes put into place after the April 16 earthquake in Ecuador, to cash assistance rolled out after the 2013 Typhoons in Viet Nam.

Within the first two weeks of October 2013, central provinces of Viet Nam were hit by two consecutive typhoons, Typhoons Wutip and Nari, resulting in 31 deaths and 330 injuries. The total economic loss was estimated at USD 734 million. In response to the disaster, the IFRC launched an emergency appeal for a period of 12 months, covering activities from relief, shelter, health, water and sanitation, livelihoods to disaster preparedness. Cash transfer was an integral part of the operation.

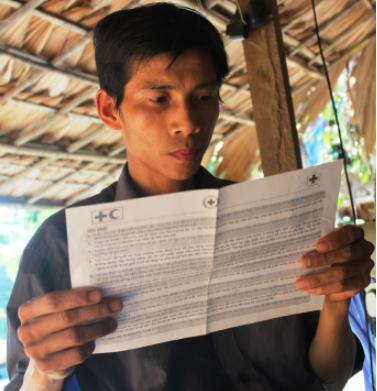

The engagement of affected communities in decision making processes related to cash grants was an integral part of the Typhoon Wutip and Nari operation. After developing selection criteria and guidelines for allocating grants, the Viet Nam Red Cross Society shared the criteria via local media and public notices. Community members were then invited to participate in village meetings to nominate beneficiaries. Following the meetings, the lists of beneficiaries were publicized on local loud speakers for three days and in public places for five days to allow for feedback from the community. With support from the IFRC, the Viet Nam Red Cross Society developed posters displaying the objectives of the cash transfer programme, the cash grant values, beneficiary selection criteria and selection process, and the hotline phone numbers in case of any questions or concerns.

When Typhoon Nari hit, the house of Tran Van Hieu, a resident of the Huong Giang commune, was inundated with flood water. His home was left completely unroofed and his family’s foodstock lost. Hieu’s family was one of the households which received a cash grant from the Viet Nam Red Cross Society, and which used the hotline phone number. With the cash grant, his family discussed and decided to invest in a cage and two pigs. This was the first time his family had enough cash in-hand for them to buy pigs. Along with cash distribution, the Red Cross also supported his family and others to complete a livestock development plan, raised their awareness about livestock related diseases and provided them with prevention as well as curative methods. After a year, his pigs already gave birth once, helping his family to recover the investment rel=”noopener noreferrer” and continue to invest.

Geneva/Ankara, 31 October 2019 – Around 1.7 million Syrians living in Turkey will continue to receive humanitarian support through an EU-funded partnership between the International Federation of Red Cross and Red Crescent Societies (IFRC) and the Turkish Red Crescent Society.

Through €500 million in EU funding, IFRC will provide monthly assistance via debit cards to the most vulnerable refugees in Turkey under the Emergency Social Safety Net (ESSN) programme. The ESSN is a multi-purpose cash transfer scheme that allows families to decide for themselves how to cover essential needs like rent, transport, bills, food, and medicine.

Read the full article on the IFRC website

By Ophélie Allard, Cash Hub Intern, British Red Cross (June-August 2019)

By Ophélie Allard, Cash Hub Intern, British Red Cross (June-August 2019)

Ophélie Allard is a master student in Contemporary International Relations, at Sciences Po Lyon

The month of July 2019 broke records according to the World Meteorological Organisation, making it the hottest month in history. All around the world, heatwave and extreme temperatures were felt, along with the acceleration of ice melting and the outbreaks of wildfires in the Arctic region. These abnormal events are the result of anthropogenic climate change. Climate change (or global warming) is a global phenomenon generated by the large amounts of greenhouses gas being released in the atmosphere, due to human activities. In the long run, it causes not only the melting of glaciers and the rise of sea levels, but also provokes droughts and floods. Through its multiple impacts, human-induced climate change also threatens economic activities and human well-being. Tropical and subtropical regions are particularly vulnerable to the phenomenon, which could further endanger already exposed communities, for instance by jeopardising food security in Sub-Saharan Africa.

Climate change is thus becoming a growing challenge for humanitarian organisations, as it increases the frequency and the intensity of extreme weather events. Every single aspect of humanitarian work is connected with climate change-related events since they impact food, shelter, health and livelihoods. This is why climate change was presented as one of the “5 Global Challenges” in the International Red Cross and Red Crescent Movement’s Strategy 2030. As climate change puts more pressure on scarce resources and exacerbates threats, the demand for disaster relief is expanding and aid agencies are asked to intensify their response. Humanitarian organisations are increasingly taking into account climate adaptation, to help the process of adjustment to expected climate effects and to lower the risks posed by climate change in people’s lives. The adaptation to climate change can be sought through multiple policies, and Cash and Voucher Assistance (CVA) could be a part of the response.

CVA was already used as a tool by the International Red Cross and Red Crescent Movement during the Franco-Prussian war (1870-1871) but in the last decade, the volume and the scale of cash transfer increased. In 2017, the International Red Cross and Red Crescent Movement helped 5.57 million people in more than 80 countries through cash programming. Evidence showed that cash assists beneficiaries by providing them with rapid liquidity, flexibility, and dignity, by allowing them to choose and prioritise their own needs. These characteristics make cash assistance an appropriate tool to reduce and adapt to climate change-related risks.

CVA can increase people’s resilience in the face of climate change, which means it can increase people’s ability to anticipate, cope and recover from a climate change-related shock. Resilience is said to be increased by CVA, because cash assistance strengthens households and local economies, and allows them to absorb the negative impacts of climate change-related shocks. The concept of resilience can be subdivided into 3 aspects: Absorptive, Anticipatory and Adaptive (called the 3As model).

“Resilience […] is understood to be the ability to anticipate, avoid, plan for, cope with, recover from and adapt to (climate related) shocks and stresses’” – Aditya Bahadur et al.

CVA has an absorptive effect, during and right after a climate change-related event, cash transfers can help absorb and cope with shocks. It leads to mitigating the immediate impact on basic needs and livelihoods, rapidly acting as a buffer.

CVA has an anticipatory effect by distributing cash to the most vulnerable groups as a proactive action, it allows people and systems to be better prepared for specific shocks. Receiving cash beforehand gives people the ability to save and to self-organise in anticipation of a weather event. This aspect of resilience is connected with other concepts such as social protection, or Forecast-based Financing which for instance was used to deliver cash grants before severe flooding by the Bangladesh Red Crescent Society in partnership with the German Red Cross in Bogura District, in northern Bangladesh.

CVA has an adaptive effect, giving people the ability to adapt to different and long-term climate risks, as well as adjusting after a shock to reduce future vulnerability. In this case, cash transfers help with asset-building and turning to economic activities less vulnerable to climate change.

The Kenya Hunger Safety Net Programme (HSNP) is a good example of the use of cash in an environment vulnerable to climate change. The HSNP provides long-term support to Kenyan households most vulnerable to food insecurity. 400,000 pastoralist households were selected to be part of the programme, of which 100,000 receive regular unconditional cash grants. During periods of droughts, the other beneficiaries can quickly receive cash assistance to mitigate the negative effects of the droughts on their economic activities. This programme integrates an anticipatory aspect, to increase resilience uphill from a weather event, as well as an absorptive effect, to provide immediate relief during droughts. This shows that social programmes such as HSNP, which aim at reducing chronic poverty and hunger through the distribution of cash, are also progressively integrating responses to climatic hazards. Similar examples within the International Red Cross and Red Crescent Movement include the response to droughts in Isiolo County, in Kenya, where cash was distributed to thousands of families relying on livestock for food, and the provision of cash assistance to people coping with the devastating impact of Hurricane Irma in the British Virgin Islands.

CVA can allow humanitarian organisations to respond to multiple causes of vulnerability, and to tailor humanitarian programmes as closely as possible to national and local needs. Without replacing other programmes, CVA can be part of the available toolbox to manage risks related to climate change. Evidently, cash should not be an automatic answer to every situation, but in a climate era which generates a more complex and uncertain environment, CVA appears as one of the key tools available for the humanitarian field to try to respond to modern challenges in a flexible and versatile way.

By Nick Polley, Response Officer, Emergencies team, International Division

By Nick Polley, Response Officer, Emergencies team, International Division

Nick was deployed as a Rotating Cash Delegate

I was recently deployed to northern Greece for 7 weeks where I joined the IFRC team implementing a multi-purpose cash assistance programme covering basic needs. I was based in Thessaloniki and worked to provide cash services to asylum seekers and refugees living in camps and those who were self-accommodated. The programme is very well established having been running since the start of the refugee crisis and my main tasks included enrolling asylum seekers into the programme, carrying out monthly certifications to check people receiving cash were still eligible to do so and trouble-shooting problems like replacing lost or expired ATM cards, unlocking PINs etc. The IFRC runs a Multi-Functional Centre (MFC) in Thessaloniki which offers cash services for people not living in camps as well as providing other services like case-work for vulnerable individuals, Greek language classes, employability skills and other integration services. The amazing staff and volunteers who work there make this centre a really valuable place for people arriving in Thessaloniki.

The majority of my time was spent in one of 16 refugee sites for which the IFRC manages the cash programme. The biggest camps host around 2000 people, but most of the sites are smaller with perhaps 300-400 people. There are also other types of accommodation like hotels or apartment blocks which are smaller still. From my time in Greece I would say people were most commonly from Syria, Iraq and Afghanistan but also many were from West and Central Africa as well as further afield like Bangladesh, Myanmar and even China. The work was similar whether in the MFC or camps, although the camp environment offers particular challenges for residents and the team – for instance some camps are quite remote and can get very hot and humid. From my own interactions with asylum seekers and speaking with others on my team, whilst there are fewer refugees arriving compared to 2014/15, the reasons forcing people to flee are the same then and now. People only leave their homes when the situation is so bad that they must escape, and the threshold for making this decision remains as high as it ever was. The difference now is that there are fewer agencies working in country and less funding available, so the NGOs which remain have to try to plug the gaps. I consequently have a huge appreciation for the work of the cash team there and the role cash assistance can play in providing much needed support to people in a dignified way. Overall, being able to work directly with refugees and understanding the range of difficulties that people in camps face – rather than reading statistics in the news – was a really rewarding experience.

By Cash Team – British Red Cross

In light of different questions we have received about cash terminology, we would like to announce that the new CaLP glossary is available here and it will be our point of reference going forward. We will seek to align to CaLP’s recommendation on the use of ‘Cash and Voucher Assistance’ (CVA), which can be used as an umbrella term as “it has the advantage of descriptively matching what it is in practice so cannot easily be misinterpreted”. However since the International Red Cross and Red Crescent Movement is often involved in Cash Assistance (CA), we will be using this term alongside CVA, to be more precise when referring to our activities.

More information can be found on the CaLP page dedicated to the glossary. Below you can also read some of the other key terminology in the CaLP’s glossary, or if you wish to consult the full list you can download the Glossary of Terminology for Cash and Voucher Assistance:

Cash and Voucher Assistance (CVA): CVA refers to all programmes where cash transfers or vouchers for goods or services are directly provided to recipients. In the context of humanitarian assistance, the term is used to refer to the provision of cash transfers or vouchers given to individuals, household or community recipients; not to governments or other state actors. This excludes remittances and microfinance in humanitarian interventions (although microfinance and money transfer institutions may be used for the actual delivery of cash).

The terms ‘cash’ or ‘cash assistance’ should be used when referring specifically to cash transfers only (i.e. ‘cash’ or ‘cash assistance’ should not be used to mean ‘cash and voucher assistance’). This term has several synonyms (see Cash Based Interventions, Cash Based Assistance, and Cash Transfer Programming). Cash and Voucher Assistance is the recommended term.

Cash Assistance: The provision of unrestricted assistance in the form of money – either physical currency or e-cash – to recipients (individuals, households or communities). The terms ‘cash’ or ‘cash assistance’ should be used when referring specifically to cash transfers only (i.e. ‘cash’ or ‘cash assistance’ should not be used to mean ‘cash and voucher assistance’).

Cash Transfer: The provision of assistance in the form of money – either physical currency or e-cash – to recipients (individuals, households or communities). Cash transfers are by definition unrestricted in terms of use and distinct from restricted modalities including vouchers and in-kind assistance.